Many companies that are part of this value chain are undergoing massive change in response to new technologies and new models for mobility that are coming to market at an exponentially faster pace and fundamentally transforming the movement of people and goods unlike anything seen since the dawn of the 20th century.

Consumers will ultimately choose the winners and losers among the companies and brands vying to deliver convenient, low-cost and customized mobility solutions.

Consumers have the power to fall in love with innovations that are more economical or make their lives easier or safer, and then propel the brands that create those innovations to globally iconic levels. They can become lifelong loyal customers, and they can just as easily turn their backs on products, services and companies they’ve trusted for decades. And that can happen faster and faster in this rapidly changing environment.

According to the Deloitte's Global Automotive Consumer 2017 Study, interest in different levels of autonomous vehicle technology varies across global markets. Consumers in China and India appear most interested perhaps due, in part, to the high number of accidents and road fatalities caused by human error.

Consumers uncertain about fully autonomous vehicles

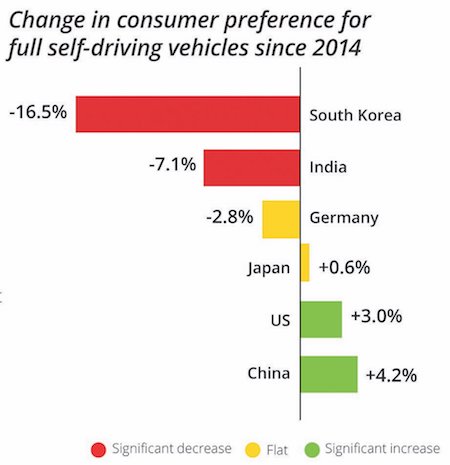

Although interest in full self-driving capabilities has risen in both China and the US since 2014, the same cannot be said for other global markets, enthusiasm for fully autonomous vehicles has flattened and even declined in several markets, according to our survey (see Chart 1).

In particular, South Korea and India have seen a large decrease in the preference of consumers for full self- driving vehicles. In South Korea there has been a dramatic drop of 16.5% and in India the drop was 7.1%. Many consumers remain sceptical about a self-driving car’s safety.

Chart 2: Percentage of consumers who feel full self-driving vehicles will not be safe

Safety still a big concern

While preference today for full self- driving vehicles varies, consumers at present appear consistent in their concerns regarding the safety of fully autonomous vehicles (see Chart 2).

Consumers in South Korea (81%) are the least likely to believe in the safety of self-driving cars followed by Japan (79%) and the US (74%). India and China are the most likely to believe in the safety of these new vehicles.

Chart 3: Types of companies consumers trust most to bring fully autonomous vehicles to market

Manufacturers or Tech Companies?

Consumer opinion appears to diverge on whom to trust to bring self-driving cars to market

In several global markets, opinions diverge between auto and tech companies in terms of whom people trust the most to make fully self- driving cars a reality of everyday life.

In some of the largest automotive markets, consumers appear to trust tech companies more than (or as much as) they trust automotive companies to bring fully autonomous technologies to market.

There is a big difference between consumer perception of car companies in Japan and the US. In Japan 76% believe that car manufacturers are the companies to be trusted with these new cars. In the US this number drops to 51%. In India, on the other hand, consumers are far more trusting of the tech sector to get this done.

Do consumers prefer to ride or drive?

In the automotive sector generally there is plenty of room for mobility services to grow and disrupt traditional notions of car ownership.

Ride-hailing services are not heavily used yet in many markets (particularly in Japan, where the regulatory environment discourages use of mobility services, see Chart 4). Use of these services in India and China far outpace other global markets. In fact, almost half of consumers in emerging markets like China and India use ride-hailing services at least once a week, eclipsing the US and South Korea, and well ahead of Germany and Japan.

Chart 4: Percentage of consumers who use ride-hailing services by frequency

The Deloitte Global Automotive Consumer Study surveyed over 22,000 consumers in 17 countries around the world. For more information and the full report please contact the authors Joseph Vitale, Global Automative Leader or Craig Gi, Vice Chairman, US Automotive Leader at Deloitte.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)